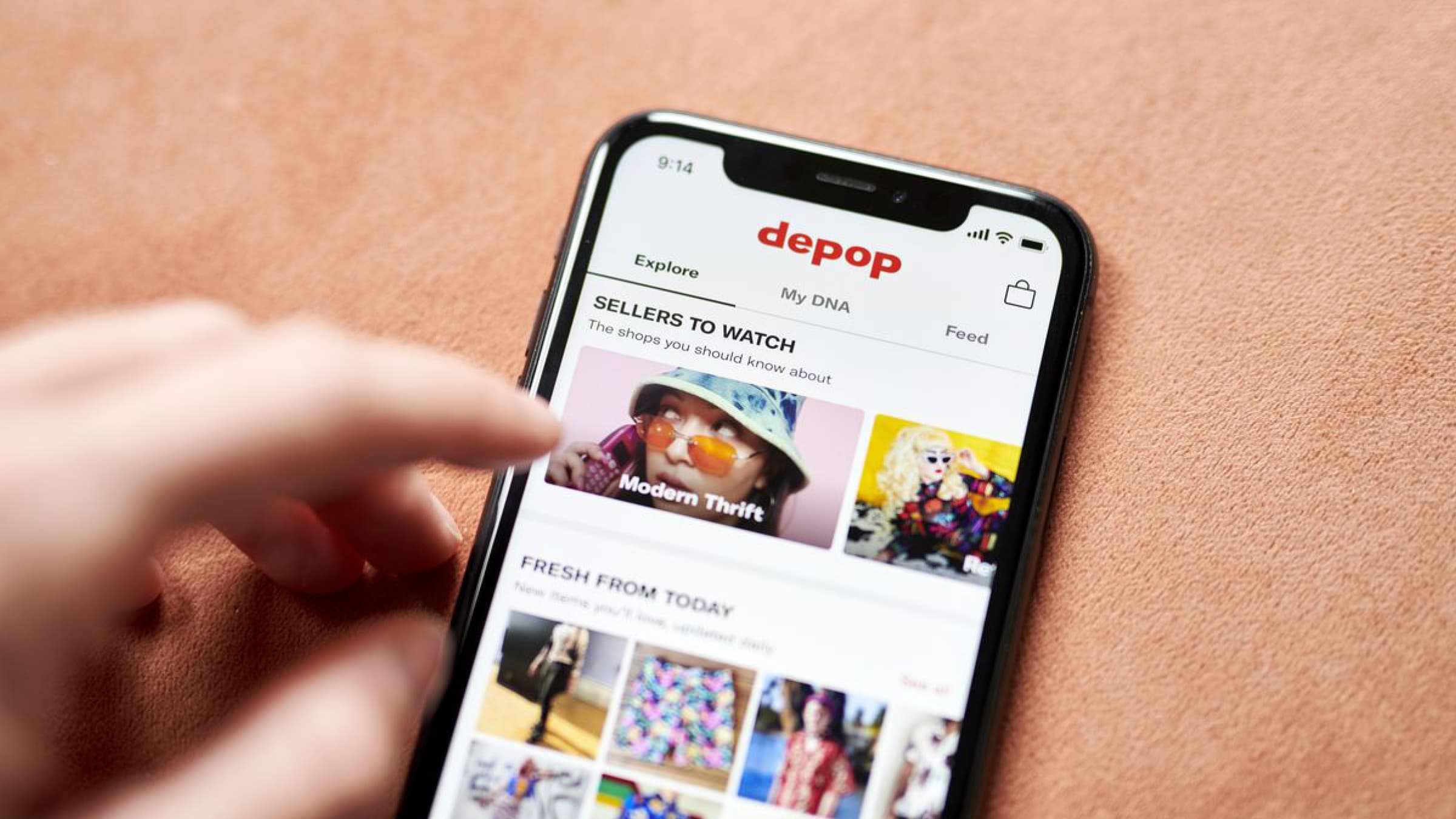

Watch out Depop girlies, the ‘side hustle tax’ is coming for you

It’s been a rough 24 hours for Depop girlies far and wide thanks to the introduction of the ‘side hustle tax’. As of January 1 2024, sellers on Vinted, eBay, Depop, and Airbnb are now obliged to collect and share seller information with HMRC.

While HMRC was already able to request information from UK-based online operators, from the start of 2024 there are new rules that the UK has signed up to via the international body, the Organisation for Economic Cooperation and Development (OECD), as part of a global effort to clamp down on tax dodgers.

Under the new rules, digital platforms will routinely report the income sellers are getting through their site and will apply to sales of goods, such as second-hand clothes or handmade items, but also services including taxi hire, food delivery and short-term accommodation lets.

HMRC said in a statement: “These new rules will support our work to help online sellers get their tax right first time. They will also help us detect any deliberate non-compliance, ensuring a level playing field for all taxpayers.”

So, if you regularly scour charity shops for clothes you can resell for ten times the price, do you need to do anything? It’s unlikely, unless you’re a really active seller. This is because sellers are granted a £1,000 tax-free allowance for ‘trading income’ – so if you’re earning below this threshold, you won’t need to fill in a tax return. In addition, under the rules set out by the OECD, platforms will not be asked to share data about sellers who make fewer than 30 transactions or under £1,735 a year.

Speaking to the BBC, Adam Jay, chief executive of Vinted, said the changes wouldn’t impact the majority of users. “It’s actually quite a small proportion of users of our platform who will trigger this threshold where we need to provide information,” he said. “It’s only those people who are making a profit from selling second-hand items that might be eligible for tax […] We’ll be actively reaching out to those sellers explaining what the new requirements are and why they exist.”

Understandably, many online have questioned the decision to go after people making a few extra pounds for themselves through side hustles when billionaires regularly evade tax by hiding their money in ‘shell’ companies or investing in real estate. But hey, we’re sure Depop sellers must be the real issue, right?